When it comes to choosing affordable assisted living for a family member, you’ll want to start by evaluating their financial situation and exploring available resources. Understanding options like Medicaid, SSI, or veterans benefits can greatly impact your choices. You might also consider smaller residential care homes, such as The Westland House, which often provide a more personal touch at a lower cost. But maneuvering this landscape can be tricky, and knowing where to look for tailored options is essential. What you discover next could change everything for your loved one’s care and comfort.

Affordable assisted living

Finding affordable assisted living options can be overwhelming, but you’re not alone in this journey. Many families face similar challenges when seeking care for their loved ones.

Start by evaluating your financial situation and exploring resources that can help. Free evaluations are available to tailor senior living options to fit your budget, ensuring you find the best match.

Consider financial assistance programs like Supplemental Security Income (SSI), which can contribute to living costs, or Medicaid, which may support personal care services for eligible low-income residents.

Veterans benefits, including VA Aid and Attendance, can also ease financial burdens for those who qualify. Financial spending profiles can help you identify potential benefits and application processes to further support your needs.

Don’t overlook state-specific programs and nonprofit organizations that often provide grants or financial aid for low-income seniors.

Additionally, HUD offers rental assistance programs, allowing seniors to pay a manageable percentage of their income for housing.

Assisted living for low-income disabled adults

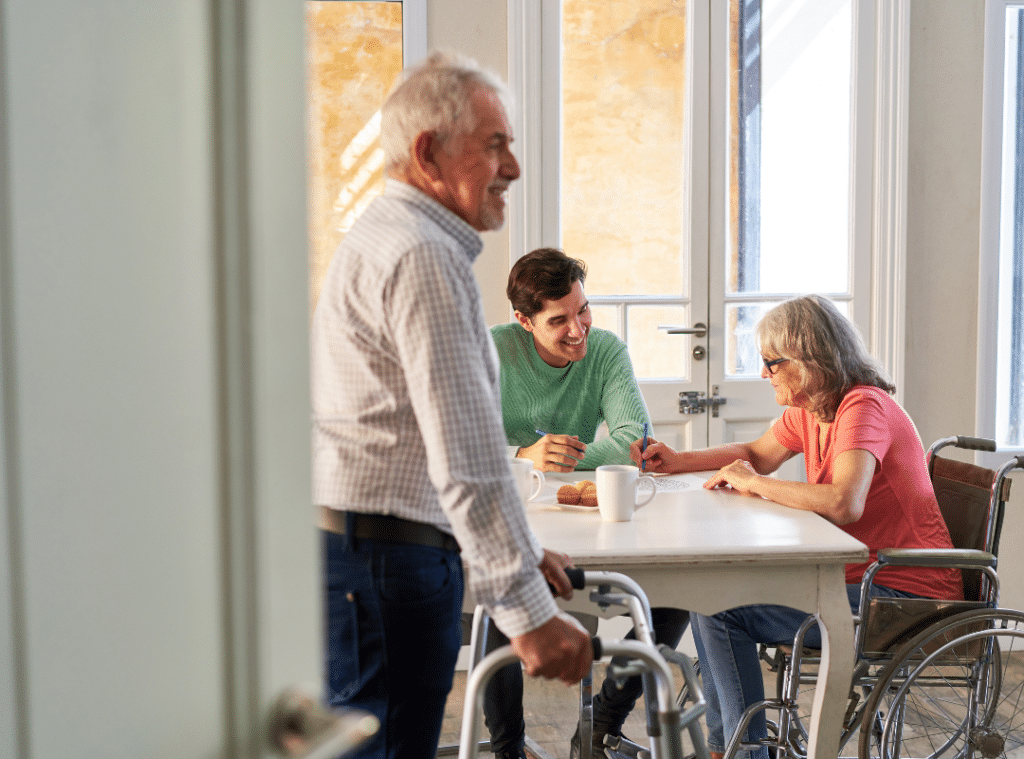

Assisted living options for low-income disabled adults can provide a supportive environment tailored to individual needs. These facilities often offer personalized care and services, making daily life more manageable and fulfilling.

To find suitable options, start by exploring local government programs that may assist with funding. Medicaid typically offers coverage for eligible residents, helping to mitigate living costs.

Consider smaller residential care homes, which can be more affordable and often deliver a more intimate setting. They may provide essential services such as meals, personal care, and companionship without the high costs associated with larger facilities.

Look into HUD’s rental assistance programs, which can help lower your housing expenses. Understanding financial planning is crucial to ensuring that you can sustain assisted living costs over time.

Low-income assisted living for seniors with no money

Maneuvering the world of low-income assisted living can be intimidating for seniors with limited financial resources. However, options are available to help you find a suitable living arrangement without breaking the bank. Many states offer Medicaid programs that provide financial assistance for assisted living, covering essential services like personal care and meal preparation.

Additionally, consider exploring Section 202 housing, where seniors typically pay only 30% of their income for rent. Nonprofit organizations also manage these properties, guaranteeing affordability while providing necessary support services.

You might want to look into residential care homes, which often have lower costs and offer a more personal environment. Many of these homes accept Medicaid, easing the financial burden considerably. The Westland House, for example, is recognized for its affordable senior housing options that cater to various care needs.

Don’t forget to utilize local resources like public housing authorities and Area Agencies on Aging; they can guide you through the application process and help identify resources tailored to your needs.

Assisted living for seniors on Social Security

Maneuvering the options for assisted living can be challenging for seniors relying on Social Security as their primary income source.

However, understanding available resources can empower you to find suitable solutions. Here are four important steps to take into account:

- Assess Budget: Determine how much Social Security provides each month and explore additional financial assistance, like Supplemental Security Income (SSI) or veterans benefits if applicable.

- Explore Housing Options: Look into low-income assisted living facilities or residential care homes, which often provide necessary services at a lower cost.

- Investigate State Programs: Research state-specific programs and Medicaid options that may help cover expenses for assisted living. Eligibility varies, so it’s important to understand local guidelines.

- Utilize Local Resources: Contact local Area Agencies on Aging or Senior Living Advisors who can guide you through assessments and available options tailored to your financial situation. Additionally, consider checking into VA Aid and Attendance Benefit to see if your family member qualifies for further financial support.

Choosing affordable assisted living for your family member can feel overwhelming, but you’re not alone in this journey. Did you know that nearly 70% of seniors will need some form of long-term care as they age? By evaluating financial options and exploring local resources, such as The Westland House, you can find a solution that meets their care needs and your budget. The Westland House is dedicated to providing quality care without compromising on affordability. Remember, with the right support and guidance, including reaching out to us at 734-326-6537, you can guarantee your loved one receives the care they deserve without breaking the bank.

Frequently asked questions

- How can I afford assisted living on Social Security?

Affording assisted living on Social Security alone can be challenging, but options are available. Consider looking into Supplemental Security Income (SSI) benefits, Medicaid assistance, or low-income housing programs designed for seniors. Many states offer financial aid or waivers to help cover assisted living costs for those with limited income. - How can I get assisted living for low income?

If you have low income, you may qualify for state Medicaid programs, which often cover part or all of the assisted living costs in participating facilities. Some states also have Medicaid waiver programs that offer more flexibility in care options. Nonprofit organizations and local agencies may provide additional financial support or subsidized housing options for seniors in need. - How is most assisted living care usually paid for?

Most assisted living care is paid for through personal savings, Social Security benefits, pensions, and long-term care insurance. Medicaid can help cover costs for eligible individuals, and veterans may access financial assistance through VA programs. Some families also help contribute to the cost of care. - What is the cheapest way for a senior to live?

The cheapest living option for a senior is often subsidized senior housing or shared living arrangements, which can significantly reduce costs. Living with family members or participating in government assistance programs like Section 8 housing can also help seniors afford safe and comfortable living environments. These options often provide basic support while keeping expenses low. - Does Michigan pay for assisted living?

Michigan offers financial assistance for assisted living through its Medicaid Home and Community-Based Services (HCBS) waiver programs, such as the MI Choice Waiver Program. These programs can help low-income seniors cover the cost of care in qualifying assisted living facilities. Eligibility requirements must be met, including income and medical necessity criteria.